Microbiome Briefing

The Growth of Probiotics in Europe

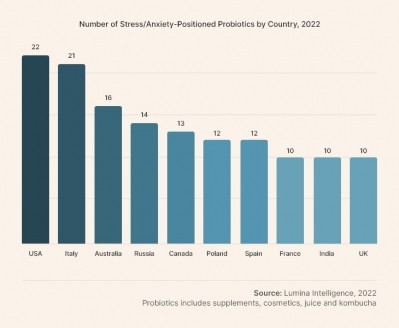

Despite the lack of an EFSA health claim in Europe for “probiotics” and EU authorities restricting use of the term on labels, more European countries are moving to allow its use, notably Spain, Denmark, Italy, Greece, Poland, the Czech Republic, the Netherlands, and Bulgaria.

France recently joined this club, allowing the term “probiotic” to be used on food supplement labels together with the wording "contributes to the balance of the intestinal flora" so long as products meet certain conditions, such as a minimum number of living cells per daily dose.

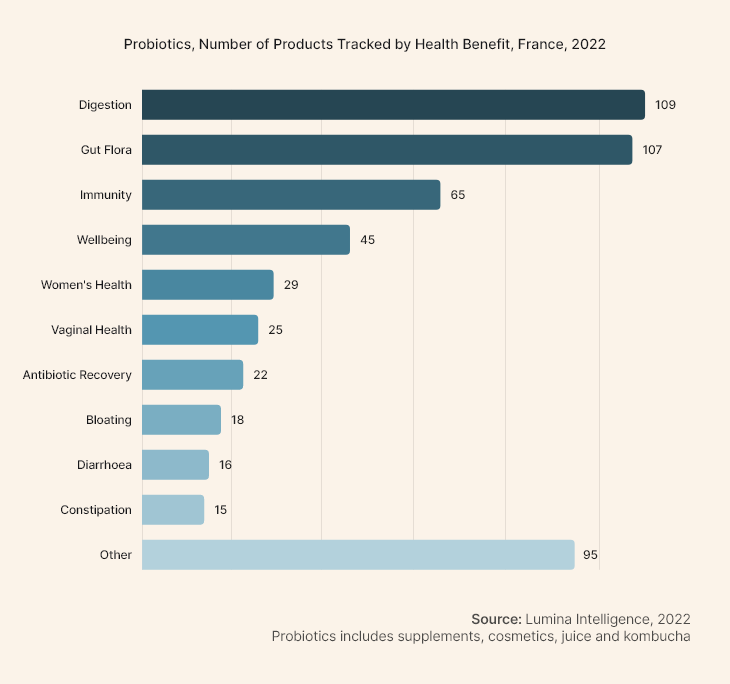

The approval of the claim will strengthen the messaging behind the top two most developed health benefits probiotic supplements in France (see chart below), and it should help industry to re-popularise the concept of the intestinal balance (and perhaps even microbiome diversity) being beneficial to overall health.

We expect the claim will also strengthen immunity-related probiotics given that so much of our immune system is found in the gut.

The take home here is that product positioning for the general “wellness” consumer will be supported, but the “symptom” consumer will have to wait...

Probiotic food supplements still represent a small part of the overall European probiotics market, which was valued at €9 billion in 2021 (supplements accounted for €1.4 billion), with a growth rate of 9% for the period 2018-2021, according to IPA Europe.

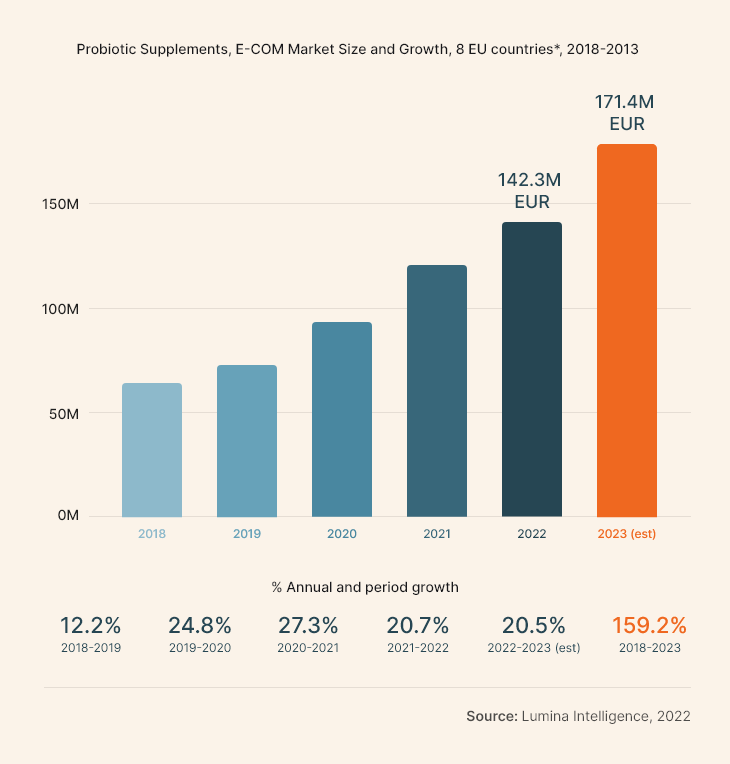

However, online sales of probiotic supplements in 8 EU countries* have surged in recent years, with data from Lumina Intelligence predicting a 20% YoY growth to yield sales of almost €142 million (US$150 million), and that was after 27% YoY growth reported in 2021.

Italy dominates with 38% of the e-commerce sales, equal to Germany and France combined. In half of the researched EU countries, e-commerce delivers already close to a quarter of the overall retail sales of probiotic supplements.

The delivery opportunity

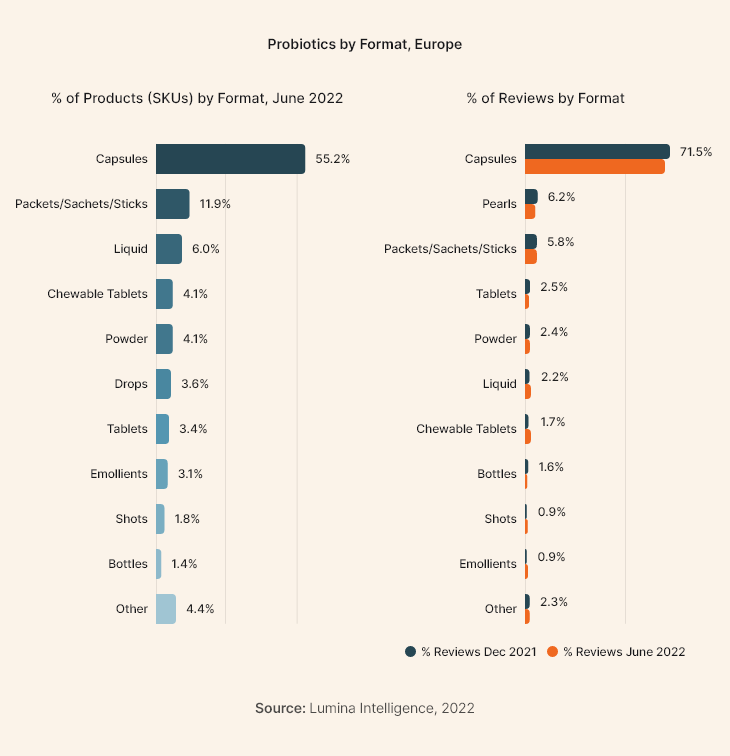

Capsules dominate with 55% of the market (June 2022, Lumina Intelligence), with packets, sachets, sticks a distant second with 12%. Interestingly, gummies and chewables are a tiny section of the European online market, representing less than 5% of all SKUs. In contract, gummies and chewables are over 12% of the market in the US, ranking 2 and 3 on the list behind capsules.

Digging into the data some more reveals some interesting between-country differences, with Finland the most advanced market for chewables, which make up 16.9% of that country’s SKUs online, according to Lumina. The next most developed market for chewables is Italy, where the format represents 6.9%. The only other European countries tracked by Lumina where market share for chewables and/or gummies is over 5% are Sweden (5.6%) and Belgium (5.3%).

Gummy supplements are reportedly the preferred delivery system for consumers aged 18-25, with a high preference for the products also seen in the 26–35-year-old group, according to Innova Market Insights, such formats offer opportunities for probiotics.

The postbiotics opportunity…

Formulators and marketers also need to factor in consumer understanding, and here work still needs to be done. For example, a survey of 8,000 consumers across eight European countries commissioned by IPA–Europe and performed by 3Gem** highlighted the impact of the restrictions around use of the term and the level to which consumers feel informed about the beneficial microorganisms. Indeed, the survey found that consumers in seven out of the eight countries reported that did not feel informed about probiotics contained in commercial products.

Lumina has also started tracking postbiotic supplements in the online space, an initiative complicated by the fact that the term “postbiotic” is rarely used, being replaced by other terms such lysates, heat-killed strains, parabiotics, short-chain fatty acids, fermentates, and many more.

While the emergence of postbiotics creates further challenges to the overall sector as consumers are exposed to yet another -biotics term, postbiotics lend themselves to greater inclusion in gummies and chewables, compared to probiotics, which need to remain viable and therefore spore-forming strains or encapsulation techniques are typically employed.

------------------------------------------------------------------------------------------------

ABOUT LUMINA INTELLIGENCE

Are you equipped for the future of biotics?

Leverage Lumina Intelligence’s data and insights on the online retail channel to uncover product development white spaces and acquisition prospects to elevate your market share and product value.