Over 90% of US supplement users consider products essential for maintaining health: CRN survey

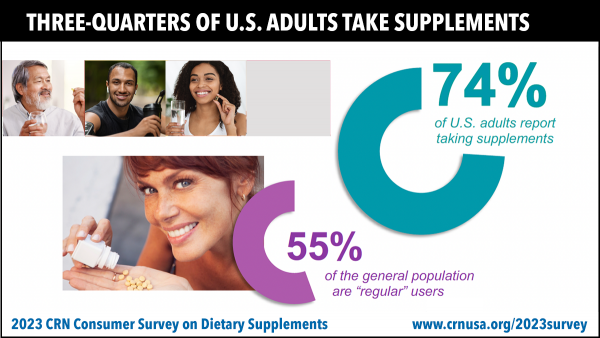

These numbers are holding relatively steady from 2022, when 75% of respondents to the Council for Responsible Nutrition’s survey* reported taking the products.

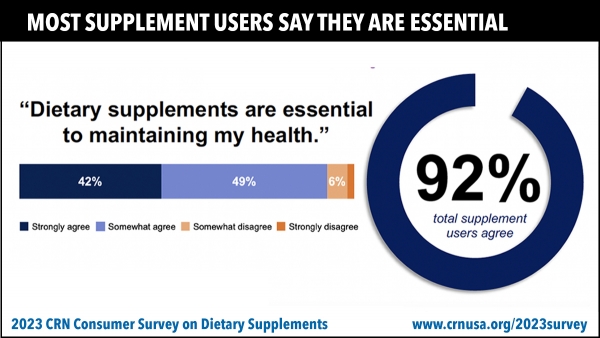

In addition, 92% of user agreed that dietary supplements are essential to maintaining their health, according to responses to a new question included in this year's survey.

The results were presented at CRN’s annual conference in California this week by Lynda Doyle, president and CEO of Avant Nutrition.

“What's really nice to see is that 95% of supplement users feel confident about the safety from taking quality supplements, and 93% feel confident about their efficacy,” Doyle told attendees. “And the other piece, non-users are more likely to say that they're confident in quality than the efficacy.”

Steve Mister, CRN’s president and CEO, commented: “Dietary supplements have become a non-negotiable component of so many Americans’ health habits—and this year’s survey data illustrates a consumer who recognizes that dietary supplements are vital to living the life they want to live.”

Categories

Digging into the details, Doyle noted that there had been some shifts in the specialty category, where melatonin and omega-3 switched places. “Melatonin is now the most widely used supplement in the specialty category at 17%, so a 4% increase, while omega-3 has dropped 4% to 13%,” she said.

“If you look at probiotics, what consumers are using probiotics for right now is mostly GI support, general health or immune health. But, think about the science that's coming out on the gut-brain axis, the science around mental health or weight management, skin health, and these are areas where we can start educating consumers and start building supplements around these benefits,” added Doyle.

There were also significant increases in usage of sports nutrition and weight management products, she said. “When we look at the specific products within the category, we're seeing use of both hydration and energy drinks and gels have a significant increase since 2022 and the primary users there are men, younger individuals and parents. So, we're seeing more people in the category and in the supplement world,” said Doyle.

And it’s not just usage in these categories that is on the rise. Confidence in the safety and quality and effectiveness of sports nutrition supplements and weight management supplements is also growing—up five percentage points to 66% for sports nutrition and four percentage points to 56% in the weight management category year-on-year.

Overall, most Americans, including those who do not use supplements, say they trust the dietary supplement industry (74%), with an even higher percentage of dietary supplement users affirming their trust in the industry (83%), consistent with recent years.

More data

The CRN survey, which has run annually since 2000, also revealed that people are using supplements not only to fill nutrition gaps they acknowledge persist but to support their more active and healthy lifestyles and their aspiration for optimal wellness. Immunity, still among the top reasons, has declined slightly as a reason users give for taking supplements.

Several of the key trend lines observed in 2022 showed continuity and stability in the market this year as well; however, a deeper dive into the data provides insights into a changing post-pandemic consumer mindset, potential growth opportunities in several product categories—as well as some weaknesses—and insights related to an array of demographics.

The survey results are generalizable to the U.S, adult population, and as in 2021 and 2022, there is oversampling of Black, Hispanic, and Asian/Pacific Islander respondents to ensure there would be sufficient supplement users in the survey to draw conclusions across specific demographics, stated CRN.

“Today's dietary supplement consumer is confident in their decision to take supplements and reports that using supplements empowers them to take charge of their health and wellness—whether their supplementation habits include supporting their weekly basketball pickup game with products for energy, hydration, or joint health, addressing their need for better sleep with melatonin, or maybe taking a daily probiotic to help make sure their mornings run according to their schedule instead of being dictated by irritable bowel syndrome,” said Mister.

* The 2023 survey was fielded for CRN by Ipsos August 9-14, 2023, and included a nationally representative sample of 3,192 U.S. adults age 18+, including 2,328 adults who reported consuming dietary supplements seasonally, occasionally, or regularly.