STATE OF THE INDUSTRY SURVEY

NutraIngredients-USA survey on the state of the US Dietary Supplements industry in 2020

These questions and more form the basis of NutraIngredients-USA’s survey report entitled, ‘State of the North America Supplements, Health & Nutrition sector 2020,’ available to download today.

The survey, conducted in association with DuPont, is an annual assessment of the dietary supplement industry’s economic performance, key trends, challenges, new products and opportunities for growth, among other subjects covered.

Back in September, NutraIngredients-USA surveyed over 280 industry professionals working across key areas within the industry to gain insider opinions into know how the indu

Reports from many dietary supplement companies to the NutraIngredients-USA editorial team of record sales in the early part of the year were supported by the survey results, with 62% of respondents agreeing that their company experienced surging sales in the first half of 2020.

Some commentators have suggested that the old seasonal demand for immune support products may be a thing of the past, certainly for the next several years.

The pandemic also accelerated the transition to online purchases for many products, including dietary supplements, as consumers limited their time in stores. Indeed, 63% of our respondents said their company had increased its online marketing and eCommerce offerings since the start of the year.

Supply chain disruption

NutraIngredients-USA has also reported on supply chain challenges this year, as raw materials and ingredients and packaging supplies in particular were squeezed due to a variety of reasons.

According to our survey, 75% of respondents reported that their company had experienced disruption, which broke down to 56% reporting some disruption and 19% reporting significant supply chain disruptions.

One of the many downsides of stretched and/or disrupted supply chains is potential price increases, which opens the door for unscrupulous players to introduce adulterated material into the market.

However, 60% of our respondents said they were no more concerned about adulteration than previous years, with 31% saying they were more concerned.

The threat of adulteration depends on the specific sector within the industry, with botanicals a particular target for fraud. For example, the ABC-AHP-NCNPR Botanical Adulterants Prevention Program (BAPP) urged buyers to be “more vigilant than ever”, with the program expressing “deep concerns about the integrity of the botanical supply chains”.

Formulation and claims

The survey also examined the industry’s opinion to ‘pill fatigue’ – the reported phenomenon whereby consumers want smaller and fewer capsules, tablets or softgels, or alternative delivery options like gummies, liquids, gels, powders, etc.

Fifty-seven percent of our respondents said that their company is focusing on novel deliver formats and dosage forms to boost compliance.

“Our company is seeing lots of new deliveries (gummies, powders, etc.),” noted one respondent, while another told us: “I don't know about fatigue, but we're focusing on other delivery formats”

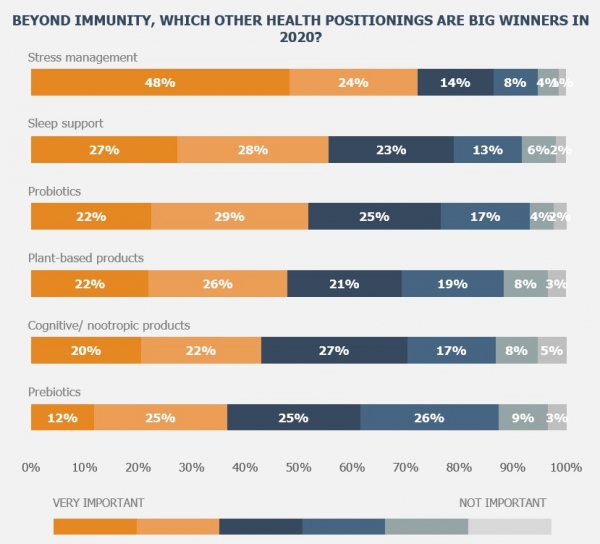

And we all know that immune products have been big winners in 2020, but we also wanted to know which other positionings had enjoyed success.

The top answer from our respondents was “stress management”, with 72% ranking it first or second as a big winner for 2020.

Related to this, this was followed by sleep support with 55% ranking it first or second.

Probiotics came third with 51%, probably linked to the immune health benefits, and overall health halo of the beneficial bugs.

Download and read

This year’s survey also explored topics such as CBD, NDIs, the claims landscape, consumer confidence, and much more.

Download NutraIngredients-USA’s survey report, ‘State of the North America Supplements, Health & Nutrition sector 2020,’ for access to our annual industry assessment and its response to the current market climate.